audit vs tax exit opportunities reddit

You just need to take some initiative meet the right people and develop your interests. Tax and Audit are both pretty good career tracks at the Big 4.

Just Got An Incredible Exit Op From Big Four Audit But Don T Feel Comfortable Sharing With Irls R Accounting

I dont think anyone says tax is a bad career only that working in public accounting in tax can be more limiting to your options.

. You work a lot with understanding the client financial reporting process how the organization makes money and how they record it. I am talking about international finance policy type stuff. Doesnt really prepare you for anything specifically which can be good.

If youre comparing purely the exit opportunities to go work on other things other than tax or audit yes audit is the clear winner because its not as specialized as tax is. Not that unusual for an university graduate to receive an offer for big 4 audit and consulting job through on campus recruiting. If you want to move on audit for sure is the better choice.

The most natural move would be something in tax. Advice at least from an Alaskans perspective - your tax exit opportunities are same as audit in that you will likely end up working for a client whether you worked on their file or not so build your client relationships. You tend to work in teams.

Include fund accounting corporate accounting management accounting internal audit. The later you leave the more likely your exit will be tax related. In Tax your exit opportunities exist in international tax as well as Federal state and local tax.

Aug 10th 2017 510 pm. Worst case you stay in public. The key difference between audit vs assurance is that audit is the systematic examination of the books of accounts and the other documents of the company to know that whether the statement shows true and fair view of the organizations whereas the assurance is the process in which the different processes.

Audit entry pays less than tax but allows for far more exit opportunities since you arent as niche youre exposed to all aspects of a business. Audit entry pays less than tax but allows for far more exit opportunities since you arent as niche youre exposed. Finished 3 year ACA with PwC Audit Dept - ask me anything PwC Graduate Scheme 2020 - Video Interview Edexcel GCSE Maths Foundation Tier 1MA1F Paper 123 359 Nov 2020 - Exam Discussion.

You are not limited to just accounting work as exit opportunities. It was the only opportunity I was given out of college for internships and fulltime. The common misconception here is that you are.

The rest can be trained. On the other hand Audit exit opportunities are more diverse and broad. At the entry level positions both industry will be looking for similar personality and soft skills.

This varies from company to company and would be the same on the auditaccountingFA side of. Audit can lead to opportunities to move into FPA at some companies with the exception of many tech startups which seem to have a preference for investment bankers due to the financial modeling experience they bring to the table. Youre exits are pretty much any accounting role.

Both audit and tax have their pros and cons. Product Control within an investment bank. If you do decide within 1-3 years that tax isnt for.

Neither Id say is easier or have significantly better schedulesseasons in the grand scheme of total hours worked. Audit is definitely more broad but that results in a wider range of potential exit opportunities as well. Much like an Investment Banking team.

Tax Exit opportunities. Etsi töitä jotka liittyvät hakusanaan Audit vs tax exit opportunities tai palkkaa maailman suurimmalta makkinapaikalta jossa on yli 20 miljoonaa. But just isolating the work itself Id say tax is more interesting and you add more value to the client.

Other than Investment Banking Corporate Finance other paths youll probably hear most of your newly-qualified Accounting peers considering will probably include. I tried applying to audit opportunities but most recruiters pushed me to apply to tax. A big 4 manager I spoke with also advised that it would be better to apply for tax positions since my resume was more suited towards that and make a switch internally.

Diversified industry experience to sell if youre looking for an industry exit strategy. 7 months Exit opportunities are definitely better for audit. Much better exit opportunities.

I was Big 4 Audit and now I am doing policy work for the federal government. Tax exit opportunities are largely limited to tax positions which is great if you really like tax. You just have to step away from the herd and look in places your peers arent.

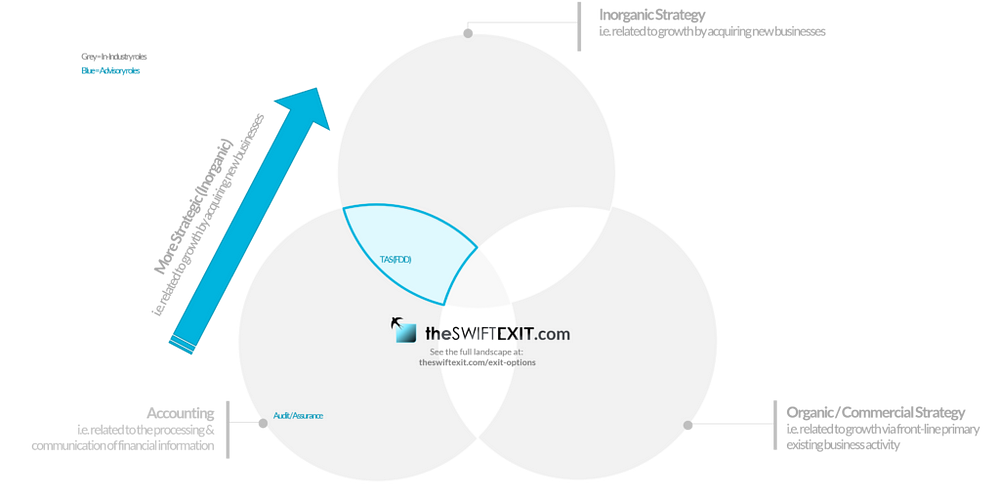

7 months Deloitte 4 Tax is better but you need to leave after 2 years. A lot of the clients we coach ask about moving into more strategic commercial roles after spending time in traditional accounting audit but dont know where to start or even what opportunities existso-much-so that weve put together a map of the landscape of accounting exit. Industry tax jobs ie.

In short audits biggest pro is that it does offer more diverse and varied exit opportunities in general because the knowledge you learn in audit is applicable to many areas. Financial Planning Analysis FPA Senior Accountant. F500 tend to be 9-5ers save for Qs and year end.

Audit Much much broader. But from what Ive seen since I started. And while you may feel more secure with the protection you still shouldnt have to pay for that peace of mind.

Exit opportunities from doing tax in public accounting are doing tax at a smaller firm opening up your own firm doing tax planning tax consulting wealth management estatewealth management corporate tax and the like. It audit exit opportunities reddit. Ago Tax US You do tax work typically for larger companies.

MyIdea Audit Vs Tax Accounting Reddit 11. People do leave later in their career for something not tax related but I like to view exit opportunities through the lens of the most natural move. Basically anything in the field of tax.

Cpas Why They Leave Where They Go

Exit Opportunities After Tax R Accounting

Should I Work In Big 4 Financial Due Diligence Fdd Work Life Reality Exposure Exit Opportunities By Theswiftexit Medium

Leaving Big 4 For Fp A After 1 5 Years And I Could Not Be Happier R Accounting

The Rise Of Cryptocurrency Exit Scams And Defi Rug Pulls Cylynx

Big 4 Transaction Services Careers Recruiting And Exits

How Is Transfer Pricing As A Career Option What Are The Exit Opportunities It Seems Like Those Tp Folks Are Different From The General Tax Folks Fishbowl

What Does A Tax Accountant Career In The Future Look Like How Much Are They Able To Make R Accounting

406 Startup Failure Post Mortems

Big 4 Exit Opportunities For Tax

![]()

Audit Vs Consulting For Exit Opportunities R Big4

3 Accounting Exit Paths That Are Widely Overlooked But Shouldn T Be The Swift Exit

Ignore An Irs Audit And It Will Go Away Right H R Block

Difference Between Audit And Tax Accounting The Big 4 Accounting Firms

Tax Exit Opportunities R Accounting

Village Inn Shuts Down Six Colorado Locations As Parent Company Files For Bankruptcy

The Rise Of Cryptocurrency Exit Scams And Defi Rug Pulls Cylynx